What is the organization’s primary exempt purpose? That’s why the second page of the 990EZ asks the question: The government simply wants to ensure that there is a good reason they’re not collecting tax money from nonprofit organizations, which is what the IRS Form 990EZ helps them figure out The annual tax forms for nonprofits, including the 990EZ, ensures that organizations don’t take advantage of this system and “reinvest” the money earned into themselves as a non-taxed profit. The U.S government willfully allows billions of dollars to go uncollected for organizations like yours to help make the world a better place. Therefore, any taxes the government were to take out would only take away from your mission, and they don’t want to do that. The 990EZ is just one type of 990, offered for small to mid-sized nonprofit organizations.įor nonprofits like yours, all of your funds will be reinvested in your mission.

FILR FORM 990 SERIES

The 990EZ is an annual tax information filing completed by many organizations that fall under the 501(c) series of statuses of the tax code, exempting them from the duty of paying taxes. Ready to learn more about the 990EZ? Let’s get started! What is a 990EZ?

FILR FORM 990 SOFTWARE

That’s where tax software and other financial services can really come in handy to make sure you’re doing what you can for your organization. If the IRS is known for anything, it’s certainly not its simplicity, easy-to-understand instructions, and award-winning customer service.

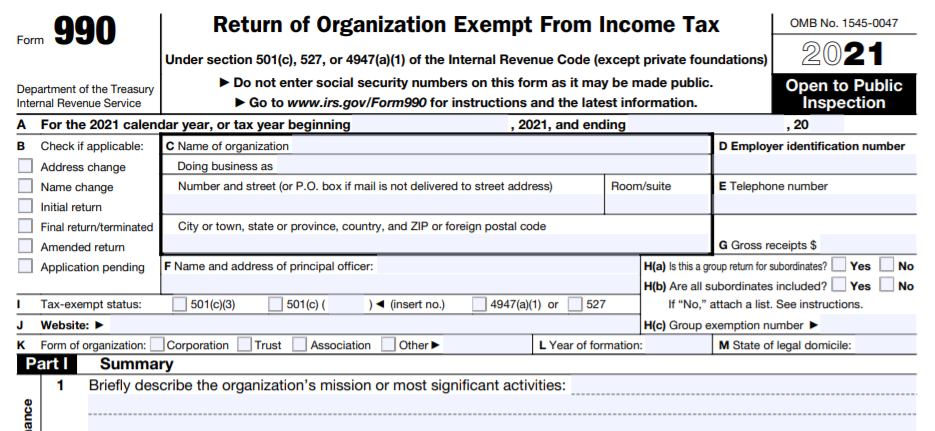

Specifically, we’ll answer the following questions: With that said, this handy guide contains a complete breakdown of the IRS Form 990EZ and everything you need to know to file for your organization. The Pepsi Zero to the IRS Form 990’s Original Pepsi, if you will.Īnd although taxes aren’t exactly fun, as a tax-exempt organization, it’s critically important to make sure you’re filing these forms correctly and on time if you want to avoid a run-in with Tax Man Uncle Sam come May. Today, we’re talking about the IRS Form 990’s little brother-the 990EZ. But once you’ve filed your Form 1023 and been granted tax-exempt status by the IRS, is your organization good to go forever? Not so fast.Įach year, eligible nonprofits must file certain tax forms to maintain their tax exemption: typically, the Form 990 or one of its variations. With ExpressTa圎xempt's helpful features, organizations can file their 990 returns quickly and easily.ĮxpressTa圎xempt's live customer support team is available via phone (70), email and chat to assist organizations during their filing and answer any questions they may have.One of the key benefits of running a 501(3)(c) nonprofit is the tax exemption that comes with it. If your organization does have a May 16th Form 990 deadline, it's important to file your return by midnight so your organization can maintain its tax-exempt status and avoid IRS penalties. With ExpressTa圎xempt, an IRS-authorized e-filing provider, organizations can securely e-file Forms 990-N, 990, 990-EZ, 990-PF, 990-T, 8868, and CA 199.

Organizations filing a 990 series return for the calendar year 2021 must file their returns electronically. ROCK HILL, SC / ACCESSWIRE / / Today is the May 16th 990 series return deadline! Your organization may have a deadline of May 16 if you operate on a calendar tax year or filed extension Form 8868 for the November 15 deadline.

0 kommentar(er)

0 kommentar(er)